Do think a borrower could have a household income of $5,000,000, quit work to be a stay-at-home parent, receive a $500,000 inheritance, and still have all their student loans forgiven by the government?

It might sound strange and counterintuitive, but the answer is Yes.

The new Pay As You Earn plan from the federal government not only makes it possible, it makes it highly likely that this scenario will happen. This new approach to student loan repayment became effective December 21, 2012. And boy does it change the nature of student loans. As I’ll show you in this example, the new plan redefines student loans in a dramatic way.

Let me show you how Pay As You Earn works. This example shows how a person can borrow $50,000 on student loans from the federal government, have a household income over the 20 year repayment of over $5,000,000, and receive $89,000 of student loan forgiveness.

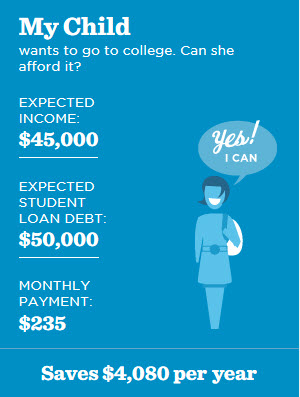

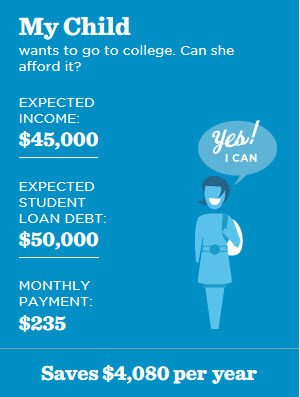

Let’s base our example on a “typical student” example at President Obama’s web site barackobama.com/education-calculator.

The graphic shows that the new Pay As You Earn plan makes it possible for your Child to go to college. It even “saves” her money along the way based on her monthly payment in year one. Of course, the plan requires payments over 20 years and promises forgiveness of any student loans that remain after that 20 year period.

So let’s fast forward her life and see how much debt might be forgiven. We’ll refer to her as Cindy. (I am using the fantastic calculator tool created by The New America Foundation to run the example. You can download the spreadsheet here.)

Cindy gets her undergraduate and graduate degrees and lands a job making $45,000 a year. Her student loans are $50,000. She qualifies for the Pay As You Earn program because she has a “partial financial hardship” (her monthly payment under Pay As You Earn is less than under the 10 year repayment plan).

She gets an apartment and starts her new life. She begins making her $235 monthly student loan payment and provides her tax return each year so her loan servicer can calculate what her monthly payment needs to be based on her income.

Over the first three years she gets a raise of 4% per year. Her monthly payment in year two goes up to $247. In year three the monthly payment goes up to $259.

Here are the numbers for the combined three year period after graduation:

Household income $140,472

Monthly payment $259

Total payments made $8,893

Student loan balance $51,419

Estimated debt forgiveness $20,610

Love Comes Calling

Another thing happened during those first three years after graduation: Cindy started dating a great guy. They fell in love and at the end of her fifth year out of school they got married. He has a great income ($250,000 a year) so they decided to file their tax returns as married filing separately otherwise the Pay As You Earn plan would calculate her monthly payment using his income as well as hers (it would use their household income if they filed jointly). The rules of the plan allow this. They aren’t gaming the system. (Remember, this is the pay as “you” earn plan, not the pay as “your spouse” earns plan.)

Things continue to go well at her job and she continued to get the 4% pay increase each year. In year eight, they welcome their first child into the world. They have their second baby in year ten and Cindy and her husband make an exciting decision. Cindy has always wanted to be a stay-at-home mom. They decide now’s the time for her to quit working and stay home with their two toddlers.

Pay As You Earn will set her monthly payment to zero since she will not be earning any money. Their household income is more than enough for them to live well and raise their young family. The assumption is Cindy’s husband is able to increase his income at 4% a year (from the $250,000 he was making when they got married).

Here are the numbers for the combined ten year period after graduation:

Household income $1,830,306 (of which $476,226 is what Cindy made)

Monthly payment $0

Total payments made $29,499

Student loan balance $54,876

Estimated debt forgiveness $89,251

Ten years into the student loan repayment and the loan balance has actually risen from when Cindy graduated. The total payments she has made of $29,449 have not paid all the interest that became due on the loans.

Over the next five years, Cindy continues to stay at home with the kids. It provides a quality of life that her family enjoys and values. Her husband continues to grow in his career and they solidify themselves in their community and their status in the middle class.

Here are the numbers for the combined fifteen year period after graduation:

Household income $3,477,753 (of which $476,226 is what Cindy made)

Monthly payment $0

Total payments made $29,499

Student loan balance $72,064

Estimated debt forgiveness $89,251

Cindy’s monthly payment went to zero back in year 10 when she quit working. If you don’t “earn” the plan does not require you to “pay”. And since you can file married filing separately on your federal tax return, your household income is not considered. That’s how the plan works. She is not doing anything wrong as far as the Pay As You Earn plan is concerned.

Her student loan balance is going up every month because there are no payments being made. All the interest that will accrue on the loan will be part of the debt forgiveness.

Cindy and her husband have talked about whether it would be smart to just pay off the student loans. If they did, the original college cost of $50,000 would have cost them $101,563 (the $29,499 paid plus the balance owed of $72,064). And right now the Pay As You Earn plan will forgive the entire balance five years from now. They struggled with what to do. The balance has been going up for so long that it doesn’t make sense to pay it off now. And one of the purposes of the plan was to make forgiveness possible. They decide to ride it out.

A $500,000 Inheritance

Cindy’s father passes away in year sixteen and leaves her an inheritance of $500,000. They put it in savings since they have already concluded that it doesn’t make financial sense to pay the debt off when it is about to be forgiven by the government. They have a net worth now of just under $2,000,000.

They continue to live their life and Cindy home schools the children. They hit the 20 year mark in the Pay As You Earn program.

Here are the numbers for the 20 years in the Pay As You Earn plan:

Household income $5,482,123 (of which $476,226 is what Cindy made)

Monthly payment $0

Total payments made $29,499

Student loan balance $0

Actual debt forgiveness $89,251

Is the New Pay As You Earn Plan Wise or Foolish?

People will have lots of reactions to this example.

Some will be shocked to learn the government will be forgiving student loans to rich people. Some will accuse people like Cindy and her husband of taking advantage of the system. Some will be pissed off that the government is putting the burden of student loans on taxpayers rather than the people who borrowed the money. Others will be excited to get into the Pay As You Earn plan.

The fascinating thing about this example is despite the appearance of helping those who do not need financial assistance; the government actually achieved the two primary objectives that led to the creation of this plan in the first place.

The first objective of the plan was to make it easier for a person to spend more of their income in the economy. This program was born during the time bailouts and stimulus money was being poured into the economy in a desperate attempt to boost economic growth and reduce unemployment. That’s why the monthly payment is set at 10% of discretionary income. It frees up cash for a person to spend more of their money to boost the economy.

The second objective was to make sure that money is not a barrier to your child going to college. The graphic on President Obama’s web site during his re-election campaign shows clearly that the government wants a parent and their child to say yes to college.

The repayment plan was created to serve those two objectives. Cindy and her husband were not gaming the system. They were just following the rules setup by the government to achieve its two objectives. She went to college and she paid a portion of her income to the government for 20 years. That’s exactly what the new plan calls for.

Pay As You Earn – The Name Says It All

The name of the plan does a great job describing how it works. It also provides a hint at where student loans are headed in the future. I’ll talk more about that in just a minute.

Let’s look at the key parts of the plan that make the forgiveness possible for Cindy.

- You “pay” on your student loans “as you earn” money. You don’t pay based on how much money you borrowed (the way every other form of debt works). So if you don’t earn, you don’t pay. That’s why Cindy was able to quit work. Her monthly payments under the program went to zero. She could stay current on the debt even without working because the plan called for zero payments based on her zero income.

- The plan is set up to look at the money “you” earn. Once you marry, the plan allows you to file as married filing separately. That way the government will only consider your income, not your spouse’s. It’s not the “pay as your spouse earns” plan. That’s why the $5,000,000 or so of income earned by Cindy’s husband after they married was not considered in setting her monthly payment.

- The debt balance grew during the entire 20 year repayment period. That’s because her monthly payment while she was working was less than the interest that accrued on her debt balance. This is the part of Pay As You Earn that many people don’t see or understand. The super low monthly payment was using the Buzz Lightyear approach to loan amortization “to infinity… and beyond”. The unpaid interest each month causes the total debt to rise each month. As the balance grows, the borrower becomes more and more dependent on the promise of forgiveness. They are basically digging themselves a deeper and deeper hole based on the government “saving them money” with the super low monthly payment. It also steers a person away from paying off the debt early because their plan all along was to accept the gift of forgiveness the government promised.

It’s this last point that provides a glimpse into the future of student loans.

Think about this for a minute. If it doesn’t matter how much you borrow, your monthly payment is based solely on your income and not on your debt, and any remaining balance after 20 years is forgiven – why even call the loans debt? Why even call them loans? Why keep track of a “student loan” balance at all? It only serves to complicate the whole process when you think about it.

If the $50,000 the government paid for Cindy to go to college was never called a loan, nothing would be any different financially. There would just be no need to track the debt or label anything as “debt forgiveness”. It’s an unnecessary administrative burden based on how the plan works.

And it’s that point that makes it possible to look into the college attendance crystal ball. The next step after Pay As You Earn is an interesting one to consider.

I’ll share my view on the future of student loans in upcoming posts.

NOTE: Be sure to drop your email address in the box below (or in the top right corner of this page) to get my posts delivered straight to your email inbox. I post one a week.