Your net worth is a very important concept (and number). It’s something you should understand and manage your entire life (unless the idea of living on ALPO later in life doesn’t bother you). ![]()

Net worth is a financial measure defined as your assets minus your liabilities and debt. It is a measure of how much of the money you have made so far you have been able to hang on to. The earlier you learn the value and importance of growing your net worth, the more likely you are to experience financial freedom in your lifetime.

Most people that come out of school with student loans have the opposite of a net worth; they have a NOT worth. And I know exactly what that looks like. I had one of those after I graduated from college too.

If you have $75,000 in assets and $50,000 in debt, you have a net worth of $25,000. It’s the equity in what you own. If you were to sell all your assets and pay off all your debt, you’d have $25,000 left over.

If you have assets of $30,000 but $50,000 of debt, you have a negative net worth. You have what I call a NOT worth. If you sold your assets, and gave all that money to your lenders, you would still owe $20,000. Not only would you have zero money, you would still owe your creditors. You would be worse than broke. You wouldn’t be worth anything (at least financially speaking).

Digging a Financial Hole

The theory behind student loans is that you take on debt in order to pay for an education that will benefit you for the rest of your life. It’s supposed to help you get a better job, develop a better career and make better money. But borrowing money to pay for your education requires you to dig a financial hole for yourself on the front end. When you graduate, you may or may not have a good paying job. But one thing’s for sure, you will have the student loans.

The education you received is an intangible asset in that, at least on day one, hasn’t made any difference at all in your net worth. It’s not an asset that would show up on your personal balance sheet. It’s up to you to make something (like money) out of your education.

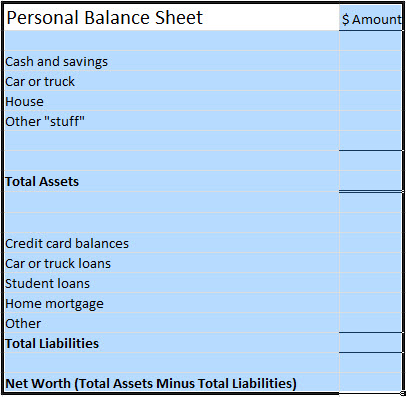

So what’s your net worth right now? Take a minute to fill in the Personal Balance Sheet below to see what your net worth is.

Do you have a net worth or a NOT worth?

Either way, work on devoting more of your income to getting rid of your student loans (and your other debt) and watch your financial position (your net worth) grow.

Let’s drive that student loan balance to zero!

Go ahead. It’s rewarding in more ways than you may realize.

_________________________________________________________

Click Here to get my blog posts delivered right to your email inbox. I publish one new post each week.

Privacy Policy: I will NEVER rent or sell your email address and you may remove yourself from this list at any time you choose.