In my last post on the new Pay As You Earn (PAYE) program from the federal government, I asked the question “Is a low monthly payment on a student loan smart”?

I walked through an example that shows how the government (the primary student loan lender) is advertising low monthly payments as “saving you money”.

Now let’s look at the program from a little different perspective.

How About a 40-Year Amortization?

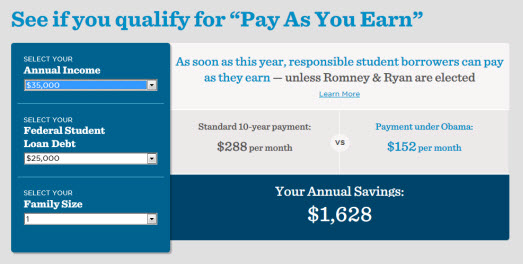

If your child came out of school with $25,000 in debt and an income of $35,000, their monthly payment under PAYE is $152. The calculator at barackobama.com/education-calculator says they save $1,628 a year with their low “Payment under Obama” as compared to the $288 per month payment under the standard 10-year payment plan.

So how many years did the government use in this example to get to the $152 monthly payment? The answer is 40 years! Ah, no wonder the monthly payment is less than a 10-year amortization.

How About an 89-Year Amortization?

Here’s another version of that example.

Let’s say your child had the same $25,000 of debt but their annual income (adjusted gross income) was $33,750. That would create a monthly payment of $142. So how many years would it take to pay off a $25,000 loan making a $142 per month payment?

The answer is 89 years. Holy cow! You would be on an 89 year amortization schedule. That’s three times as long as a 30 year mortgage.

Does that seem weird to you? Does that seem downright dumb (for both the lender and the borrower)?

And the government says you will be saving money by making this low monthly payment?

Now the rest of the story…

The government doesn’t really want you to take 89 years to pay them back (they know you’ll probably be dead by then). So they created a new wrinkle. The new Pay As You Earn program says that if you make all your monthly payments on time for 20 years (240 monthly payments without fail) they will forgive the balance at the end of the 20 years.

They know there is likely to be a balance at the end so they will just forgive it for you. The government will erase your debt.

No mention that they will also send you a 1099 since the amount forgiven is treated as taxable income. And the tax is due immediately – in full. Kind of like getting a beautifully wrapped Christmas present – only to find a financial bomb inside.

What’s Up?

The government wants more students going to school. Offering student loans with low monthly payments and the promise of debt forgiveness is the carrot they are using to get more people to say yes to college (no matter how much it costs).

They also want people to spend more of their money after they graduate on buying cars, buying houses, and participating fully as a consumer. That’s one reason they are providing the super low monthly payment.

They are also assuming that your income will go up over time and you will be able to pay more than when you first get out of school.

But encouraging a person to stay in debt for 20+ years is more likely to hurt them financially rather than help them become financially independent.

It teaches the opposite of don’t buy things you can’t afford. It teaches the opposite of get out of debt and save money.

So back to the question: Is a small student loan payment wise or foolish?

Send me an email and let me know what you think.